In a significant move that reflects the evolving landscape of finance and technology, Nasdaq has introduced new rules aimed at enhancing the regulatory framework for companies seeking to list on its exchange. These changes come at a time when the cryptocurrency market is gaining traction, with more companies looking to leverage the benefits of public trading. Nasdaq’s new regulations are designed to ensure that companies meet stringent standards of transparency and accountability, which is particularly crucial in the often-volatile world of cryptocurrencies.

By establishing a more robust framework, Nasdaq aims to foster investor confidence and promote a healthier market environment. The introduction of these rules is not merely a regulatory formality; it represents a paradigm shift in how traditional financial institutions view digital assets. As cryptocurrencies continue to gain legitimacy, Nasdaq’s proactive approach signals a willingness to embrace innovation while maintaining the integrity of the financial markets.

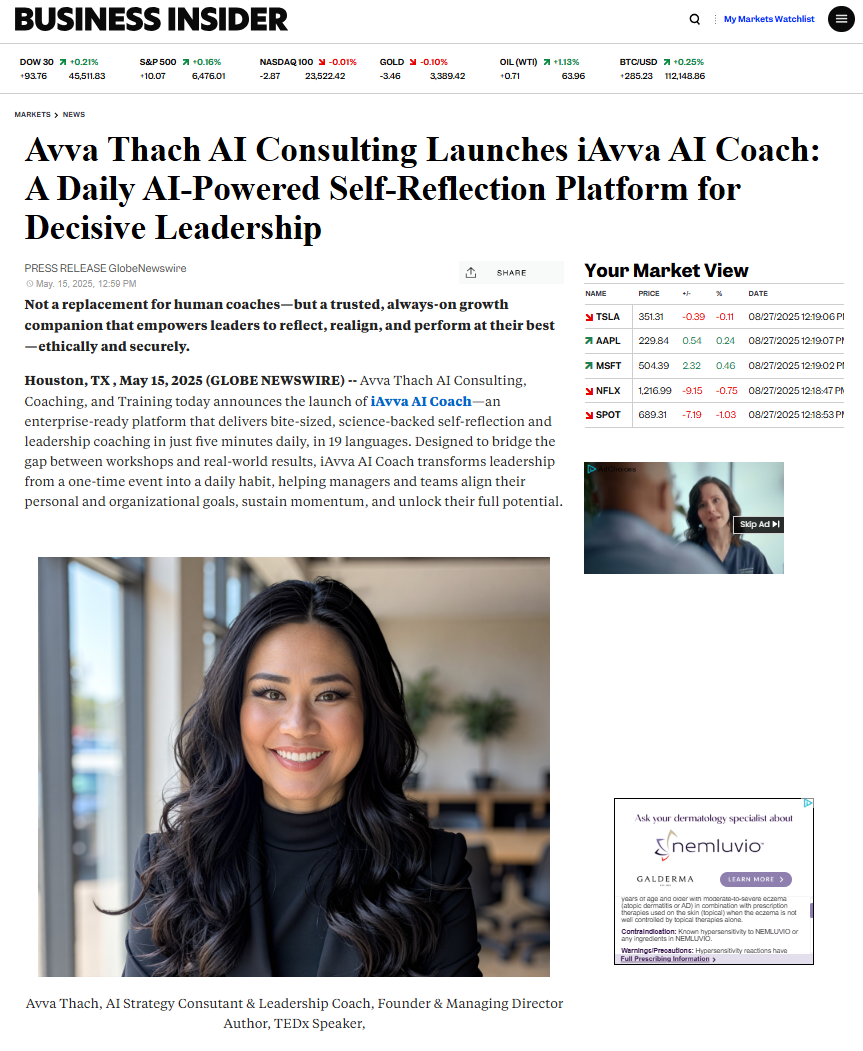

This dual focus on innovation and regulation is essential for creating a sustainable ecosystem where both investors and companies can thrive. The implications of these new rules extend beyond Nasdaq itself, potentially influencing other exchanges and regulatory bodies as they navigate the complexities of cryptocurrency integration. Try iAvva AI coach app for free.

Key Takeaways

- Nasdaq has introduced new rules for cryptocurrency companies looking to list on the exchange, impacting the way these companies operate and are regulated.

- Cryptocurrency companies seeking to list on Nasdaq will need to meet specific requirements related to financial reporting, internal controls, and anti-money laundering measures.

- Compliance with regulations and investor protection measures are key aspects of Nasdaq’s new rules, aiming to ensure transparency and security for investors in the cryptocurrency market.

- The new rules have sparked reactions in the cryptocurrency market, with companies evaluating the implications and potential challenges of meeting Nasdaq’s listing requirements.

- The future outlook for crypto stock deals on Nasdaq will depend on how cryptocurrency companies adapt to the new rules and the reactions of institutional investors, with experts offering varied opinions and analysis on the matter.

Impact on Cryptocurrency Companies

The new rules set forth by Nasdaq are poised to have a profound impact on cryptocurrency companies seeking to go public.

This shift could lead to a consolidation within the industry, as only those companies that can meet these heightened standards will be able to access public markets.

For many smaller or less established firms, this could mean reevaluating their business models or seeking additional funding to bolster their compliance efforts. Moreover, the emphasis on transparency and accountability may also lead to increased scrutiny from investors and regulators alike. Cryptocurrency companies will need to demonstrate not only their financial viability but also their commitment to ethical practices and risk management.

This could result in a more mature market where only the most resilient and well-managed companies succeed. As a consequence, investors may find themselves with a clearer understanding of the risks associated with investing in cryptocurrency firms, ultimately leading to a more stable investment environment.

Requirements for Listing on Nasdaq

To align with its new regulatory framework, Nasdaq has outlined specific requirements that cryptocurrency companies must meet to qualify for listing. These include comprehensive disclosures regarding financial performance, governance structures, and risk management practices. Companies will be required to provide detailed information about their business models, revenue streams, and operational strategies, ensuring that potential investors have access to critical data before making investment decisions.

Additionally, Nasdaq is likely to require that cryptocurrency companies adhere to established accounting standards and undergo regular audits by reputable firms. This move aims to enhance the credibility of these companies in the eyes of investors and regulators alike. By establishing clear guidelines for listing, Nasdaq is not only protecting investors but also encouraging cryptocurrency firms to adopt best practices that can lead to long-term sustainability and growth.

Compliance and Regulation

| Regulation | Compliance Metric | Target |

|---|---|---|

| GDPR | Percentage of data breaches reported within 72 hours | 100% |

| SOX | Number of internal control deficiencies | 0 |

| PCI DSS | Percentage of systems with up-to-date antivirus software | 100% |

Compliance with Nasdaq’s new rules will necessitate a cultural shift within many cryptocurrency companies.

This may involve hiring legal experts, compliance officers, and financial analysts who can ensure adherence to both Nasdaq’s requirements and broader regulatory frameworks.

Furthermore, the integration of compliance into corporate culture will be essential for long-term success. Companies must foster an environment where compliance is viewed as a fundamental aspect of their operations rather than a mere checkbox exercise. This cultural shift can lead to improved risk management practices and greater overall resilience in the face of market fluctuations.

Investor Protection Measures

One of the primary objectives behind Nasdaq’s new rules is to enhance investor protection measures within the cryptocurrency space. By requiring greater transparency and accountability from listed companies, Nasdaq aims to mitigate risks associated with fraud, mismanagement, and market manipulation. Investors will benefit from improved access to information that can inform their decision-making processes, ultimately leading to more informed investment choices.

Additionally, Nasdaq’s focus on investor protection aligns with broader regulatory trends aimed at safeguarding retail investors in the cryptocurrency market. As more individuals enter this space, it becomes increasingly important to establish mechanisms that protect them from potential pitfalls. By setting high standards for listed companies, Nasdaq is taking proactive steps toward creating a safer investment environment for all participants.

Cryptocurrency Market Reaction

The cryptocurrency market has responded with a mix of optimism and caution following Nasdaq’s announcement of new listing rules. On one hand, many industry stakeholders view these regulations as a positive development that could lend legitimacy to the market and attract institutional investors. The prospect of increased transparency and accountability may encourage more traditional investors to consider cryptocurrency assets as viable investment options.

On the other hand, there are concerns about how these regulations may impact smaller or emerging cryptocurrency companies that may struggle to meet the new requirements. The fear is that increased compliance costs could stifle innovation and limit access to public markets for promising startups. As the market continues to digest these changes, it will be crucial for stakeholders to engage in constructive dialogue about how best to balance regulation with innovation.

Comparison with Other Stock Exchanges

When comparing Nasdaq’s new rules with those of other stock exchanges, it becomes evident that there is a growing trend toward stricter regulations for cryptocurrency listings across the board. For instance, exchanges like the New York Stock Exchange (NYSE) have also begun implementing measures aimed at enhancing transparency and investor protection within the cryptocurrency space. This alignment among major exchanges reflects a broader recognition of the need for robust regulatory frameworks as digital assets gain prominence.

However, there are notable differences in how various exchanges approach regulation. While Nasdaq emphasizes comprehensive disclosures and governance structures, other exchanges may prioritize different aspects of compliance or adopt more flexible approaches. This divergence highlights the importance of understanding each exchange’s unique requirements when considering listing options for cryptocurrency companies.

Implications for Institutional Investors

The introduction of Nasdaq’s new rules carries significant implications for institutional investors looking to enter the cryptocurrency market. With enhanced transparency and accountability measures in place, institutional investors may feel more confident allocating capital to publicly listed cryptocurrency firms. This influx of institutional investment could further legitimize the market and contribute to its maturation.

Moreover, as institutional investors increasingly seek exposure to digital assets, they will likely demand higher standards of governance and risk management from the companies they invest in. This shift could drive cryptocurrency firms to adopt best practices that align with institutional expectations, ultimately benefiting both parties in the long run.

Potential Challenges for Cryptocurrency Companies

Despite the potential benefits of Nasdaq’s new rules, cryptocurrency companies may face several challenges as they navigate this evolving landscape. One significant hurdle is the cost associated with compliance efforts. Smaller firms may struggle to allocate resources toward meeting stringent regulatory requirements while also focusing on growth and innovation.

Additionally, there is the challenge of adapting existing business models to align with new regulations. Companies may need to reevaluate their operational strategies and make significant changes to their governance structures in order to qualify for listing on Nasdaq. This process can be time-consuming and resource-intensive, potentially diverting attention away from core business activities.

Future Outlook for Crypto Stock Deals

Looking ahead, the future outlook for crypto stock deals appears promising yet complex. As more cryptocurrency companies seek public listings on exchanges like Nasdaq, there will likely be an increased focus on compliance and governance standards across the industry. This trend could lead to greater consolidation within the market as only those firms capable of meeting these requirements succeed in going public.

Furthermore, as investor demand for cryptocurrency assets continues to grow, we may see an expansion of innovative financial products designed specifically for this market segment. The intersection of traditional finance and digital assets presents exciting opportunities for both investors and companies alike.

Expert Opinions and Analysis

Industry experts have weighed in on Nasdaq’s new rules, highlighting both the potential benefits and challenges associated with this regulatory shift. Many believe that enhanced transparency will ultimately lead to greater investor confidence in the cryptocurrency market, paving the way for increased institutional participation. However, some caution against overly stringent regulations that could stifle innovation or limit access for smaller firms.

As the landscape continues to evolve, ongoing dialogue among stakeholders—including regulators, industry leaders, and investors—will be essential for shaping a balanced approach that fosters growth while ensuring adequate protections are in place. The future of cryptocurrency listings on exchanges like Nasdaq will depend on how well these various interests can align in pursuit of a common goal: creating a sustainable and thriving market for digital assets.

In light of Nasdaq’s increased scrutiny on companies engaging in crypto stock deals, which now requires shareholder votes and could potentially extend the deal process while mandating more disclosures, businesses are navigating a complex landscape. This heightened oversight comes as crypto treasury stocks increasingly explore exotic tokens, reflecting a broader trend of integrating digital assets into traditional financial frameworks. For companies looking to adapt to these changes, understanding the broader implications of technological advancements is crucial. An insightful resource on this topic is the article on The Impact of Artificial Intelligence on Business Operations, which explores how AI is reshaping business strategies and could offer valuable insights for companies dealing with the evolving crypto regulations.

FAQs

What is Nasdaq’s new scrutiny of companies loading up on crypto?

Nasdaq is now requiring shareholder votes for some crypto stock deals, which could prolong the deal process and force more disclosures.

Why is Nasdaq implementing these new rules?

Nasdaq is implementing these rules in response to the increasing trend of crypto treasury stocks turning to exotic tokens, which may pose risks and require more transparency.

How will Nasdaq’s rules affect the deal process for companies involved in crypto?

Nasdaq’s rules could prolong the deal process for companies involved in crypto, as they will now need to seek shareholder votes and provide more disclosures.

What are some potential implications of Nasdaq’s new rules for companies involved in crypto?

The new rules could potentially lead to more transparency and accountability for companies involved in crypto, as well as a more thorough evaluation of the risks and benefits of their crypto investments.

Leave a Reply