In recent years, artificial intelligence (AI) has emerged as a transformative force across various industries. The rise of AI valuations reflects the growing recognition of its potential to revolutionize business operations, enhance customer experiences, and drive innovation. Companies that harness AI technologies are often viewed as more competitive and capable of achieving significant growth.

This perception has led to soaring valuations for AI startups and established firms alike, creating a buzz in the investment community. The surge in AI valuations can be attributed to several factors, including advancements in machine learning, increased data availability, and the proliferation of cloud computing. As organizations seek to leverage AI for improved decision-making and operational efficiency, investors are eager to capitalize on this trend.

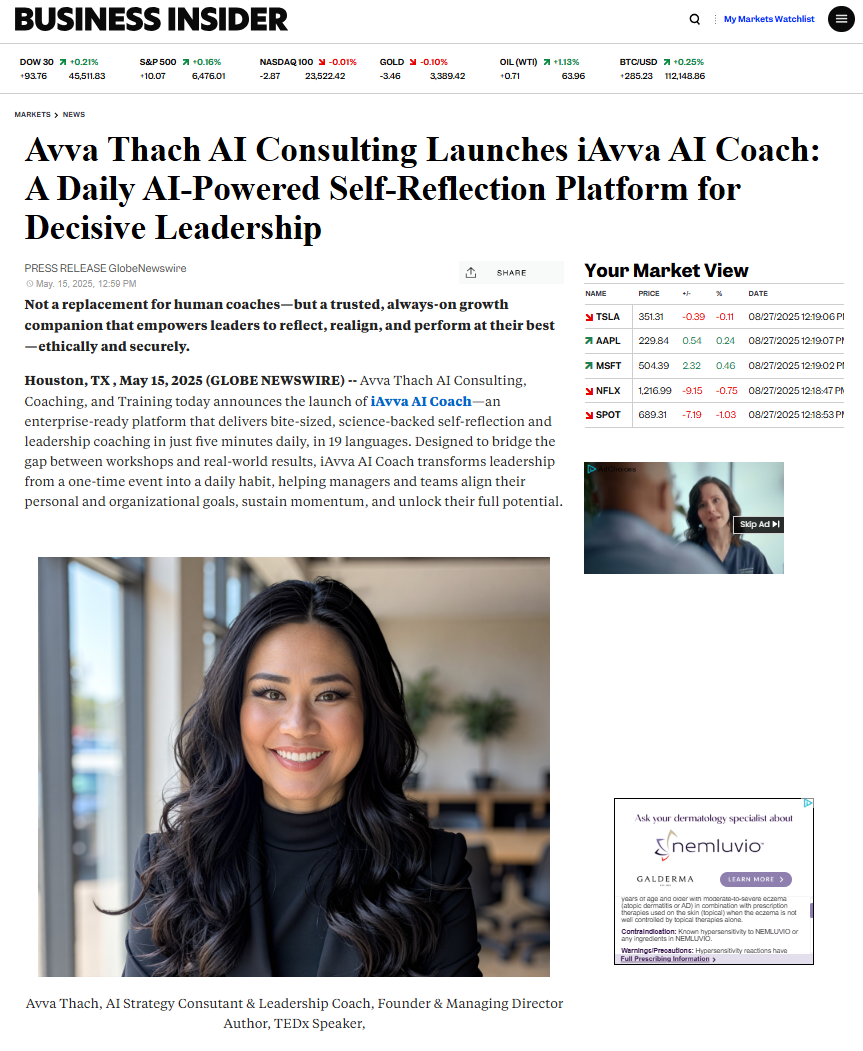

The result is a landscape where AI companies are frequently valued at astronomical figures, often exceeding traditional metrics used to assess business worth. Download iAvva AI https://iavva.my-ai.coach/#/.

Key Takeaways

- AI valuations are on the rise, with increasing interest and investment in AI technology and companies.

- Factors driving AI valuations include the potential for disruptive innovation, scalability, and the ability to generate significant returns on investment.

- There is a debate about whether AI valuations are overinflated, with concerns about hype and unrealistic expectations.

- AI valuations have a significant impact on investment and funding, influencing decisions and shaping the landscape of the AI industry.

- Navigating the risks and opportunities of AI valuations requires careful evaluation, strategic planning, and a deep understanding of the market.

Understanding the Factors Driving AI Valuations

Several key factors contribute to the rising valuations of AI companies. First and foremost is the rapid advancement of technology. Breakthroughs in algorithms and computing power have made it possible for AI systems to perform complex tasks with unprecedented accuracy.

This technological evolution has not only attracted attention from investors but has also led to increased demand for AI solutions across various sectors. Another significant factor is the growing volume of data generated daily. With the advent of the Internet of Things (IoT) and the expansion of digital platforms, businesses now have access to vast amounts of data.

AI technologies excel at analyzing this data, uncovering insights that can drive strategic decision-making. As organizations recognize the value of data-driven insights, they are more inclined to invest in AI solutions, further driving up valuations.

The Debate: Are AI Valuations Overinflated?

Despite the excitement surrounding AI valuations, there is an ongoing debate about whether these valuations are justified or overinflated. Critics argue that many AI companies are being valued based on hype rather than solid financial fundamentals. They point to instances where startups have received substantial funding despite lacking a clear path to profitability or a sustainable business model.

On the other hand, proponents of high valuations argue that the potential for disruption and innovation in the AI space justifies the investment. They contend that traditional valuation metrics may not fully capture the long-term value that AI technologies can bring to businesses. As a result, investors may be willing to overlook short-term financial performance in favor of the transformative potential of AI.

The Impact of AI Valuations on Investment and Funding

| Metrics | Data |

|---|---|

| AI Valuations | Increasing rapidly |

| Investment in AI | Growing steadily |

| Funding for AI startups | On the rise |

| Impact on tech industry | Significant |

The rising valuations of AI companies have significant implications for investment and funding dynamics. Venture capitalists and private equity firms are increasingly allocating resources to AI startups, driven by the belief that these companies will shape the future of various industries. This influx of capital has led to a competitive landscape where startups must differentiate themselves to attract funding.

Moreover, high valuations can create challenges for companies seeking investment. As expectations rise, startups may feel pressure to deliver rapid growth and innovation to justify their valuations. This can lead to a focus on short-term gains rather than long-term sustainability, potentially jeopardizing their future success.

Investors must carefully assess whether a company’s valuation aligns with its growth potential and market position.

Navigating the Risks and Opportunities of AI Valuations

As with any investment landscape, navigating the risks and opportunities associated with AI valuations requires careful consideration. One significant risk is the potential for market correction. If investors begin to question the sustainability of high valuations, it could lead to a downturn in funding for AI companies.

This scenario could disproportionately affect startups that rely heavily on external financing. Conversely, there are numerous opportunities for companies that successfully leverage AI technologies. Organizations that invest in AI can enhance operational efficiency, improve customer experiences, and drive innovation.

By staying ahead of industry trends and adopting a proactive approach to AI integration, businesses can position themselves for long-term success in an increasingly competitive market.

The Future of AI Valuations: Trends and Predictions

Looking ahead, several trends are likely to shape the future of AI valuations. One key trend is the increasing focus on ethical AI practices. As concerns about bias and transparency in AI systems grow, companies that prioritize ethical considerations may gain a competitive edge.

Investors are likely to favor organizations that demonstrate a commitment to responsible AI development. Additionally, as more industries adopt AI technologies, we can expect a diversification of valuation models. Traditional metrics may evolve to account for factors such as social impact and sustainability.

This shift could lead to more nuanced assessments of AI companies’ worth, reflecting their contributions beyond mere financial performance.

Strategies for Evaluating and Assessing AI Valuations

Evaluating and assessing AI valuations requires a multifaceted approach. Investors should consider both quantitative and qualitative factors when determining a company’s worth. Financial metrics such as revenue growth and profitability remain important, but they should be complemented by an analysis of the company’s technology stack, market positioning, and competitive landscape.

Furthermore, engaging with industry experts and conducting thorough due diligence can provide valuable insights into a company’s potential for success. Investors should also be mindful of emerging trends in the AI space, as these can significantly impact valuations over time. By adopting a comprehensive evaluation strategy, investors can make informed decisions that align with their risk tolerance and investment goals.

The Ethical and Social Implications of AI Valuations

The rise of AI valuations also raises important ethical and social considerations. As companies strive for higher valuations, there is a risk that they may prioritize profit over ethical considerations. This could lead to the development of AI systems that perpetuate bias or infringe on privacy rights.

To mitigate these risks, stakeholders must advocate for responsible AI practices that prioritize transparency and accountability. Investors should support companies that demonstrate a commitment to ethical development and social responsibility. By fostering an environment where ethical considerations are integral to business strategy, we can ensure that the benefits of AI are realized while minimizing potential harm.

In conclusion, the rise of AI valuations presents both opportunities and challenges for investors and businesses alike. By understanding the factors driving these valuations, navigating associated risks, and prioritizing ethical considerations, stakeholders can position themselves for success in an evolving landscape where artificial intelligence plays an increasingly central role in shaping our future.

Leave a Reply