The artificial intelligence (AI) investment landscape is rapidly evolving, presenting both opportunities and challenges for investors. As businesses increasingly recognize the potential of AI to drive efficiency and innovation, the demand for AI technologies has surged. According to a report by McKinsey, global investment in AI is expected to reach $1 trillion by 2025.

This growth is fueled by advancements in machine learning, natural language processing, and computer vision, which are transforming industries from healthcare to finance. Investors must understand the dynamics of this landscape to make informed decisions. The AI market is characterized by a mix of established players and startups, each offering unique solutions.

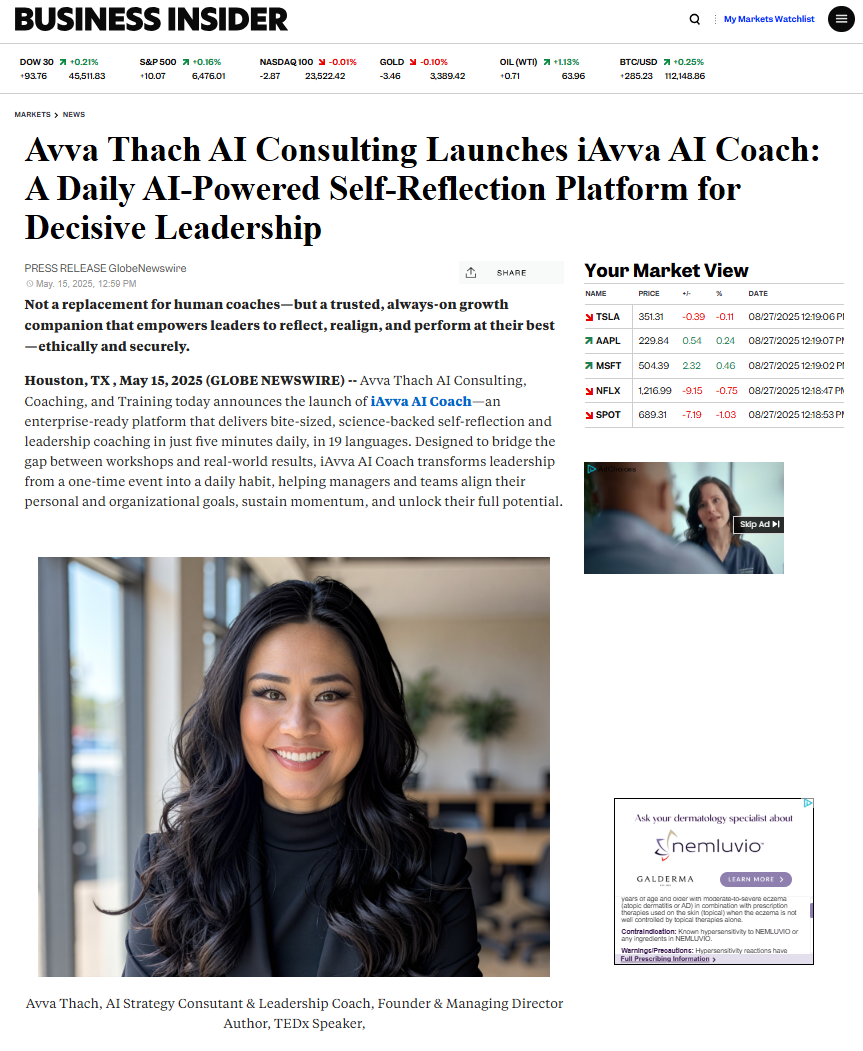

Major tech companies like Google, Microsoft, and Amazon are heavily investing in AI research and development, while smaller firms often focus on niche applications. This diversity creates a rich tapestry of investment opportunities but also necessitates a thorough understanding of the technology and its potential impact on various sectors. Download iAvva AI https://iavva.my-ai.coach/#/

Key Takeaways

- AI investment landscape is rapidly evolving with a wide range of opportunities and risks.

- Promising AI technologies and applications include machine learning, natural language processing, and computer vision.

- Evaluating AI investment opportunities requires thorough research and understanding of the market and technology.

- Risks of AI investments include data privacy concerns, regulatory changes, and technological limitations.

- Selecting the right AI investment strategy involves considering factors such as risk tolerance, investment goals, and time horizon.

Identifying Promising AI Technologies and Applications

Identifying promising AI technologies and applications is crucial for successful investment. Key areas to watch include automation, predictive analytics, and AI-driven customer experiences. Automation technologies, such as robotic process automation (RPA), are streamlining operations across industries, reducing costs, and increasing productivity.

For instance, UiPath, a leader in RPA, has seen significant growth as companies seek to automate repetitive tasks. Predictive analytics is another area ripe for investment. By leveraging data to forecast trends and behaviors, businesses can make more informed decisions.

Companies like Palantir Technologies are at the forefront of this space, providing powerful analytics tools that help organizations harness their data effectively. Additionally, AI-driven customer experience solutions are transforming how businesses interact with their customers. Chatbots and virtual assistants are becoming commonplace, enhancing customer service while reducing operational costs.

Evaluating AI Investment Opportunities

Evaluating AI investment opportunities requires a strategic approach. Investors should consider factors such as market demand, technological feasibility, and competitive landscape. Conducting thorough market research is essential to identify trends and assess the potential for growth.

For example, the healthcare sector is increasingly adopting AI for diagnostics and treatment planning, driven by the need for improved patient outcomes. Investors should also evaluate the technological capabilities of potential investments. Understanding the underlying technology and its scalability is vital for assessing long-term viability.

Companies that demonstrate a strong commitment to research and development are often better positioned to adapt to changing market conditions. Furthermore, analyzing the competitive landscape can provide insights into potential risks and rewards associated with specific investments.

Assessing the Risks of AI Investments

| Metrics | Value |

|---|---|

| AI Investment Amount | 100,000,000 |

| Projected ROI | 15% |

| Market Volatility | High |

| Regulatory Risk | Medium |

| Technology Risk | Low |

While AI investments offer significant potential rewards, they also come with inherent risks. One major risk is the rapid pace of technological change. The AI landscape is constantly evolving, and companies that fail to keep up may quickly become obsolete.

Investors must be prepared for the possibility that their chosen technologies may not achieve widespread adoption or may be outpaced by competitors. Another risk involves regulatory challenges. As governments around the world grapple with the implications of AI, new regulations may emerge that impact how companies operate.

Investors should stay informed about regulatory developments and consider how they may affect their investments. Additionally, ethical considerations surrounding AI, such as bias in algorithms and data privacy concerns, can pose reputational risks for companies involved in AI development.

Selecting the Right AI Investment Strategy

Selecting the right AI investment strategy is crucial for maximizing returns while managing risk. One approach is to focus on established companies with a proven track record in AI development. These firms often have the resources and expertise to navigate the complexities of the market successfully.

Investing in exchange-traded funds (ETFs) that focus on AI technologies can also provide diversification while minimizing individual stock risk. Another strategy involves seeking out early-stage startups with innovative solutions. While these investments carry higher risk, they can also offer substantial rewards if the company succeeds.

Conducting thorough due diligence is essential when considering startup investments, as many early-stage companies may lack a proven business model or revenue stream.

Diversifying AI Investment Portfolios

Diversifying AI investment portfolios is a key strategy for mitigating risk and enhancing returns. Investors should consider allocating funds across various sectors that are adopting AI technologies. For example, investing in healthcare, finance, retail, and manufacturing can provide exposure to different applications of AI while reducing reliance on any single industry.

Additionally, diversifying across different stages of company development can further enhance portfolio resilience. Combining investments in established firms with those in emerging startups allows investors to balance stability with growth potential. This approach can help investors navigate market fluctuations while capitalizing on the diverse opportunities presented by the AI landscape.

Navigating Regulatory and Ethical Considerations in AI Investments

Navigating regulatory and ethical considerations in AI investments is increasingly important as governments implement new policies governing technology use. Investors must stay informed about regulations that may impact their investments, such as data protection laws and guidelines for algorithmic transparency. Understanding these regulations can help investors assess potential risks associated with specific companies or technologies.

Ethical considerations also play a significant role in AI investments. Companies that prioritize ethical AI development are more likely to build trust with consumers and stakeholders. Investors should evaluate a company’s commitment to ethical practices, including diversity in data sets and transparency in algorithmic decision-making.

Supporting companies that prioritize ethical considerations can lead to more sustainable long-term growth.

Monitoring and Managing AI Investments for Long-Term Success

Monitoring and managing AI investments for long-term success requires ongoing diligence and adaptability. Investors should regularly review their portfolios to assess performance against market trends and technological advancements. Staying informed about industry developments can help investors identify emerging opportunities or potential risks.

Engaging with portfolio companies can also provide valuable insights into their strategies and challenges. Building relationships with management teams allows investors to stay informed about developments within the company and industry at large. Additionally, being open to adjusting investment strategies based on changing market conditions can enhance long-term success in the dynamic AI landscape.

In conclusion, navigating the AI investment landscape requires a strategic approach that balances opportunity with risk management. By understanding the technologies at play, evaluating investment opportunities carefully, and staying informed about regulatory and ethical considerations, investors can position themselves for success in this rapidly evolving field. Diversifying portfolios and actively managing investments will further enhance resilience and growth potential in the exciting world of artificial intelligence.

Leave a Reply