Khosla Ventures, founded by Vinod Khosla in 2004, has established itself as a prominent player in the venture capital landscape, particularly in the realm of technology and artificial intelligence (AI). The firm is known for its forward-thinking approach and its ability to identify transformative technologies that can reshape industries. As AI continues to evolve, Khosla Ventures has made bold predictions about the future of AI investments, emphasizing the potential for significant returns in this rapidly growing sector.

With a keen eye for innovation, Khosla Ventures is not just investing in AI; it is shaping the future of how we interact with technology. The firm’s predictions are grounded in extensive research and a deep understanding of market trends. Khosla Ventures believes that AI will not only enhance existing technologies but also create entirely new markets.

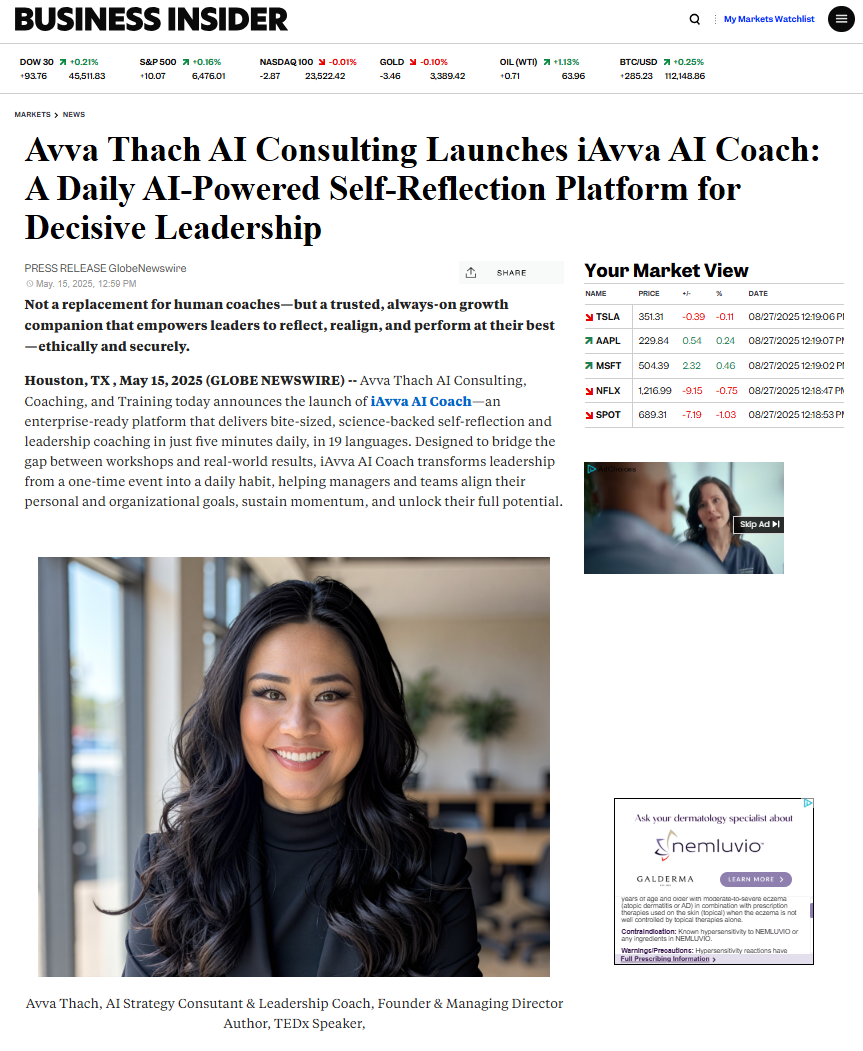

This perspective is crucial for investors looking to navigate the complexities of the AI landscape. By focusing on the potential of AI to drive efficiency and innovation, Khosla Ventures positions itself at the forefront of a technological revolution that promises to redefine our world. Download iAvva AI https://iavva.my-ai.coach/#/.

Key Takeaways

- Khosla Ventures is a prominent venture capital firm with a focus on AI investments, and they have made predictions about the future of AI investment.

- Megacorn Alpha Dogs are the top companies in the AI industry that have the potential for asymmetrical gains and significant market impact.

- Asymmetrical gains in AI investments can be influenced by factors such as technological advancements, market demand, and regulatory environment.

- Potential Megacorn Alpha Dogs in the AI market can be identified through their innovative technology, strong leadership, and market scalability.

- Evaluating risk and reward in AI investment strategies involves assessing factors such as market competition, technology maturity, and regulatory risks.

Understanding Megacorn Alpha Dogs in the AI Industry

In the context of AI investments, “Megacorn Alpha Dogs” refers to those companies that have achieved extraordinary growth and market dominance. These firms are characterized by their ability to leverage AI technologies to create innovative solutions that address pressing challenges across various sectors. Understanding these alpha dogs is essential for investors seeking to capitalize on the burgeoning AI market.

Megacorn Alpha Dogs often exhibit unique traits that set them apart from their competitors. They possess a strong vision for the future, a robust technological foundation, and an agile approach to market changes. These companies are not just following trends; they are setting them.

By investing in Megacorn Alpha Dogs, investors can tap into a wealth of opportunities that arise from their pioneering efforts in AI development.

Factors Contributing to Asymmetrical Gains in AI Investments

Asymmetrical gains in AI investments occur when the potential upside significantly outweighs the downside risk. Several factors contribute to this phenomenon, making AI an attractive area for investment. First, the rapid pace of technological advancement means that early investors can benefit from exponential growth as new applications and solutions emerge.

Additionally, the increasing demand for AI-driven solutions across industries creates a fertile ground for investment. Companies are eager to adopt AI technologies to enhance efficiency, reduce costs, and improve customer experiences. This growing demand translates into higher valuations for companies that successfully harness AI capabilities.

Investors who recognize these trends early can position themselves to reap substantial rewards.

Identifying Potential Megacorn Alpha Dogs in the AI Market

| Company Name | Market Cap (in billions) | AI Revenue (in millions) | AI Market Share |

|---|---|---|---|

| 1,500 | 10,000 | 20% | |

| Amazon | 1,700 | 8,500 | 15% |

| Microsoft | 2,000 | 12,000 | 25% |

| IBM | 800 | 6,000 | 10% |

Identifying potential Megacorn Alpha Dogs requires a strategic approach that combines market analysis with an understanding of emerging technologies. Investors should look for companies that demonstrate strong leadership, innovative product offerings, and a clear path to scalability. These attributes are often indicative of a company’s potential to become a market leader.

Moreover, investors should pay attention to startups that are addressing significant pain points within their industries. Companies that provide solutions to pressing challenges are more likely to gain traction and achieve rapid growth. By focusing on these key indicators, investors can identify promising candidates for their portfolios and position themselves for success in the competitive AI landscape.

Evaluating Risk and Reward in AI Investment Strategies

Investing in AI comes with its share of risks and rewards. On one hand, the potential for high returns is enticing, especially as AI technologies continue to advance and permeate various sectors. On the other hand, the volatility of the tech market and the uncertainty surrounding regulatory frameworks can pose challenges for investors.

To effectively evaluate risk and reward, investors should conduct thorough due diligence on potential investments. This includes analyzing market trends, assessing competitive landscapes, and understanding the regulatory environment. By taking a comprehensive approach to risk assessment, investors can make informed decisions that align with their investment goals while navigating the complexities of the AI market.

Khosla’s Approach to Identifying and Nurturing AI Startups

Khosla Ventures employs a unique approach to identifying and nurturing AI startups. The firm focuses on building strong relationships with entrepreneurs and providing them with the resources they need to succeed. This includes not only financial support but also access to a network of industry experts and mentors who can guide startups through their growth journeys.

Khosla Ventures also emphasizes the importance of fostering innovation within its portfolio companies. By encouraging a culture of experimentation and creativity, the firm helps startups develop cutting-edge solutions that can disrupt traditional markets. This hands-on approach not only enhances the likelihood of success for individual startups but also contributes to the overall growth of the AI ecosystem.

The Future of AI Investment and the Role of Megacorn Alpha Dogs

The future of AI investment is bright, with Megacorn Alpha Dogs poised to play a pivotal role in shaping this landscape. As these companies continue to innovate and expand their reach, they will drive advancements in technology that benefit various sectors, from healthcare to finance and beyond. Investors who align themselves with these alpha dogs can expect to see significant returns as they capitalize on the growth potential of AI.

Moreover, as more industries adopt AI technologies, the demand for skilled talent will increase. This presents additional opportunities for investors to support educational initiatives and training programs that prepare the workforce for an AI-driven future. By investing in both technology and talent development, stakeholders can ensure sustainable growth within the AI sector.

Navigating the AI Investment Landscape with Khosla’s Predictions

Navigating the AI investment landscape requires a strategic approach informed by insights from industry leaders like Khosla Ventures. By understanding the dynamics of Megacorn Alpha Dogs and recognizing the factors contributing to asymmetrical gains, investors can position themselves for success in this rapidly evolving market. Khosla’s predictions serve as a valuable guide for those looking to capitalize on the transformative potential of AI.

As we look ahead, it is clear that AI will continue to be a driving force behind innovation and economic growth. By aligning investment strategies with emerging trends and supporting visionary startups, investors can play a crucial role in shaping the future of technology. Embracing this journey will not only yield financial rewards but also contribute to a more advanced and efficient world powered by artificial intelligence.

Leave a Reply